Std 12 Home Learning videos.

Great U.S. Equity Index Mutual Funds

The index mutual fund industry has only grown in size and popularity since it began with Vanguard's 500 Index Fund in 1976. Index funds track the components of a market index, such as the Standard & Poor's 500 Index, and mutual funds are investment vehicles comprising a pool of funds collected from many investors. Often, investors are increasingly attracted to index mutual funds for their low operating expenses, low portfolio turnover, and broad and diversified market exposure, as well as the opportunity to invest passively.

Here, we take a look at just four top U.S. equity index mutual funds: the Vanguard 500 Index Fund (VFINX), the Vanguard Total Stock Market Index Fund (VTSMX), the Fidelity 500 Index Fund (FXAIX) and the Schwab Total Stock Market Index Fund (SWTSX). All information presented here was accurate as of March 2020.

KEY TAKEAWAYS

Index funds have become increasingly popular among investors over the past decade.

These low-cost mutual funds are passive investments that seek to replicate a major stock market index rather than try to beat it.

Here, we look at four excellent index mutual funds that you may want to consider.

Vanguard 500 Index Fund (VFINX)

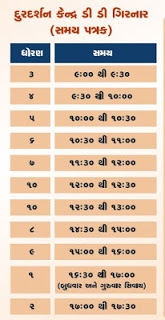

ડીડી ગિરનાર ચેનલ ટાઈમ ટેબલ

The index fund that started it all remains one of the best for its overall long-term performance and low cost. The Vanguard 500 Index Fund has dutifully matched the returns of the S&P 500 index for more than four decades while charging management fees of just 0.14%. Its assets of more than $500 billion are invested in 508 different large-cap stocks weighted by market capitalization based on the actual S&P 500 index. The Vanguard 500 Index Fund has returned an average of around 11% annually since its inception.

Great U.S. Equity Index Mutual Funds

Vanguard Total Stock Market Index Fund (VTSMX)

The Vanguard Total Stock Market Index Fund was among the first funds to invest in the total stock market by including mid-and small-cap stocks, which has enabled it to outperform the S&P 500 over the last several years. Indeed, the fund holds 3,561 individual stocks, about 7x more than the Vanguard 500 fund. This $840 billion fund instead tracks the MSCI U.S. Broad Market Index, which comprises nearly 100% of the total market capitalization of U.S. stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. The Vanguard Total Stock Market Index Fund has returned an average of 9.65% annually since its inception and, like the Vanguard 500 Index Fund, it also has a 0.14% expense ratio.

The Fidelity 500 Index Fund (FXAIX)

Next to Vanguard, Fidelity offers the widest range of index funds available in the industry. Its flagship index fund is the Fidelity 500 Index Fund, which has more than $219 billion in assets invested in 505 stocks, with a tilt toward the information technology, financial, healthcare, and consumer discretionary sectors. Because the fund can invest as much as 20% of its assets outside of the S&P 500 Index, it tends to be a little more volatile than the index, but it also offers the potential to outperform the index. The fund has returned an average of 12.3% annually since inception, and its 0.015% expense ratio is one of the lowest available.

Schwab Total Stock Market Index Fund (SWTSX)

Vanguard and Fidelity may dominate the index fund industry in terms of size, but Schwab has come on strong with its own menu of low-cost funds, led by the $10.5 billion Schwab Total Stock Market Index Fund. This fund tracks the Dow Jones U.S. Total Stock Market Index, which consists of the entire U.S. stock market. The fund is allowed to invest in short-term derivatives and futures contracts to close the performance gap that typically exists between the fund and the index. It may also choose to focus investments in a particular sector or group of sectors based on their relative weighting in the index. Since its inception, Schwab Total Stock Market Index Fund returned an annual average of 6.7% and has a very low expense ratio of 0.03%.

IMPORTANT LINK FOR VIDEO::

October 2021

DATE 01-10-2021 LIVE CLASS Maths

DATE 04-10-2021 LIVE CLASS Maths

DATE 05-10-2021 LIVE CLASS Maths

DATE 06-10-2021 LIVE CLASS Maths

DATE 11-10-2021 LIVE CLASS Statistics

DATE 12-10-2021 LIVE CLASS Statistics

DATE 13-10-2021 LIVE CLASS Statistics

DATE 14-10-2021 LIVE CLASS Statistics

DATE 16-10-2021 LIVE CLASS Statistics

DATE 18-10-2021 LIVE CLASS Statistics

DATE 20-10-2021 LIVE CLASS English

DATE 21-10-2021 LIVE CLASS English

DATE 22-10-2021 LIVE CLASS English

DATE 23-10-2021 LIVE CLASS Biology

DATE 25-10-2021 LIVE CLASS Chemistry

DATE 26-10-2021 LIVE CLASS Chemistry

DATE 27-10-2021 LIVE CLASS Chemistry

DATE 28-10-2021 LIVE CLASS Chemistry

DATE 29-10-2021 LIVE CLASS Chemistry

DATE 30-10-2021 LIVE CLASS Biology

January 2022

DATE 10-01-2022 LIVE CLASS VIDEO

DATE 11-01-2022 LIVE CLASS VIDEO

DATE 12-01-2022 LIVE CLASS VIDEO

DATE 13-01-2022 LIVE CLASS VIDEO

DATE 15-01-2022 LIVE CLASS VIDEO

DATE 17-01-2022 LIVE CLASS VIDEO

No comments:

Post a Comment